Estate Planning

Is Long-Term Care Insurance a Good Investment?

Many people wonder if long-term care insurance is a good investment. Middle-aged and older people, especially those in their 50s and 60s, often contemplate buying long-term health care insurance. In the end, only about 2.3% of this age group actually purchase it. The hesitancy is understandable, as consumers grapple with today’s known cost of premiums […]

Read More

Qualifying for a Mortgage With Retirement Income

It used to be difficult for retirees to borrow, buy, or refinance a mortgage because lenders insisted on seeing their current income – the kind you get from having a job. Thankfully, Freddie Mac has guidelines for lenders that helps them use retirement funds to qualify borrowers for a home loan. When your loan is guaranteed […]

Read More

Why Hire an Elder Law Attorney?

Many elder law attorneys specialize in estate planning, incapacity planning, and end-of-life care for seniors. These practitioners are essential because they work to protect a vulnerable population. To plan for their future and their care, seniors and their families should consider hiring an elder law attorney. Having a plan for your aging loved one’s care […]

Read More

The Step-Up in Basis Rule is an Heir’s Best Friend

If you receives assets that were included in a person’s estate, you get a stepped-up cost basis. That means that you determine any gain or loss on the future sale of that asset using the date of death value of the person from whom you inherited the asset. The step-up tax adjustment has been under […]

Read More

Choosing the Right Probate Lawyer

You have been named executor in a will. Now what? First, you are under no obligation to retain the original attorney who prepared the will. In fact, assuming you are the executor, that initial lawyer must now turn over the will to you. As you start your search, you will find a vast pool of […]

Read More

What To Know About Trusts and Taxes

For all intents and purposes, a trust is considered its own entity. Trusts are legal documents, but they are also taxed separately from those to whom the assets within a trust will be distributed. People who are in the process of planning their estates rely on trusts because trusts serve as protection over the assets […]

Read More

A Close Look at the Duties of a Trustee

The most important part of choosing a Trustee is trust. The highest ethical standards are required for all types of trustees, whether they are dealing with personal assets or business interests. In all cases, the golden rule is that a trustee must put the beneficiary’s interest first. Important guiding principles The first and foremost duty […]

Read More

When Death Do Us Part

Unlike a unilateral will, a prenup is a bilateral agreement crafted between two people. Ideally, a prenup will be drafted in alignment with the corresponding will. However, in situations in which the two documents are in direct contradiction with one another, courts tend to prioritize the prenup over the will as long as the former […]

Read More

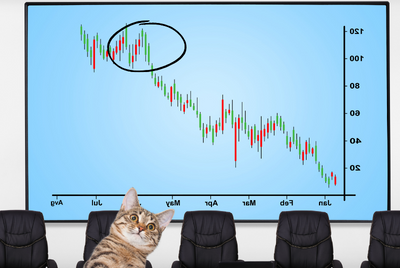

What Is a Dead Cat Bounce?

This colorful term is used to describe a technical phenomenon that occurs during a significant market downtrend. After weeks or even months of grinding lower, asset prices appear suddenly and inexplicably to change direction and spring back to life. Puzzled traders wonder, is this the big turnaround they have been desperately awaiting? Has the wind […]

Read More

Should You Add Your Children to Your Deed and Bank Accounts?

Many people believe that an easy way to avoid probate and enable your children to assist you as you age is to add your children to your bank accounts and even the deed to your home. But this strategy doesn’t always work as planned. Suppose your child causes a severe car accident. Your account can […]

Read More